SUBSCRIPTION BILLING IMPLEMENTATION & MIGRATION DOCUMENT

Subscription billing-

1. Enables organisation to manage subscription revenue opportunities and recurring billing through billing schedules

2. Revenue allocations are easily managed and are billed and recognised at the line level.

Business Scenarios-

What is deferral-

Deferral in account is something which we defer posting to actual Ledgers at the time of Original transactions and later recognize to actual ledger posting.

3 types of subscription billing-

1. Recurring contract billing

2. Revenue and expense deferrals

3. Multi element revenue allocation

How to enable S.Billing:-

Enable subscription billing feature name first and then enable other three feature names as per below screenshot

Overall process:-

Configure deferrals

Create schedule and generate transactions

Review generated active deferrals

Process deferrals schedule

Review final posting

Key configurations: -

* Enable subscription billing feature

* Item setup for deferrals

* Posting profile - Sales order, purchasing, general journal, free text invoice, invoice journal

* Deferral templates

IF YOU ARE USING REVENUE AND EXPENSE DEFERRALS METHOD OF IMPLEMENTING SUBSCRIPTION BILLING IN THIS DOCUMENT NOW-

1. Create deferral templates first

Note: Period Frequency we can keep Daily, Monthly and Fiscal periods (Fiscal period depends on the period followed by company it might be quarterly/four months once.

* Deferral template can be either recognised or skipped

* Recognised can be given full 12 months, lets say we have received subscription amount in January but company wants to recognise revenue from april.

* so for three months we can choose skipped and recognised will be 12 and skipped will be those months not recognised

2. Create deferral defaults: -

* Deferral defaults is nothing but posting profile in Subscription billing module, define the main account which should hit for deffered revenue.

* Item code is standard whether all, group or item level we can define the main account.

We had created the deferral template first now some items/services may be having deferral only for 6 months/3 months or whole year so we can define it here for those.

Items under template button as below-

Now Create a sales order-

* Click on Deferrals, we will be able to see revenue deferral account which is where deffered revenue should be posted and also there is a main account

*Defined for actual revenue recognition which will get posted every month on month. Check the details and post the invoice.

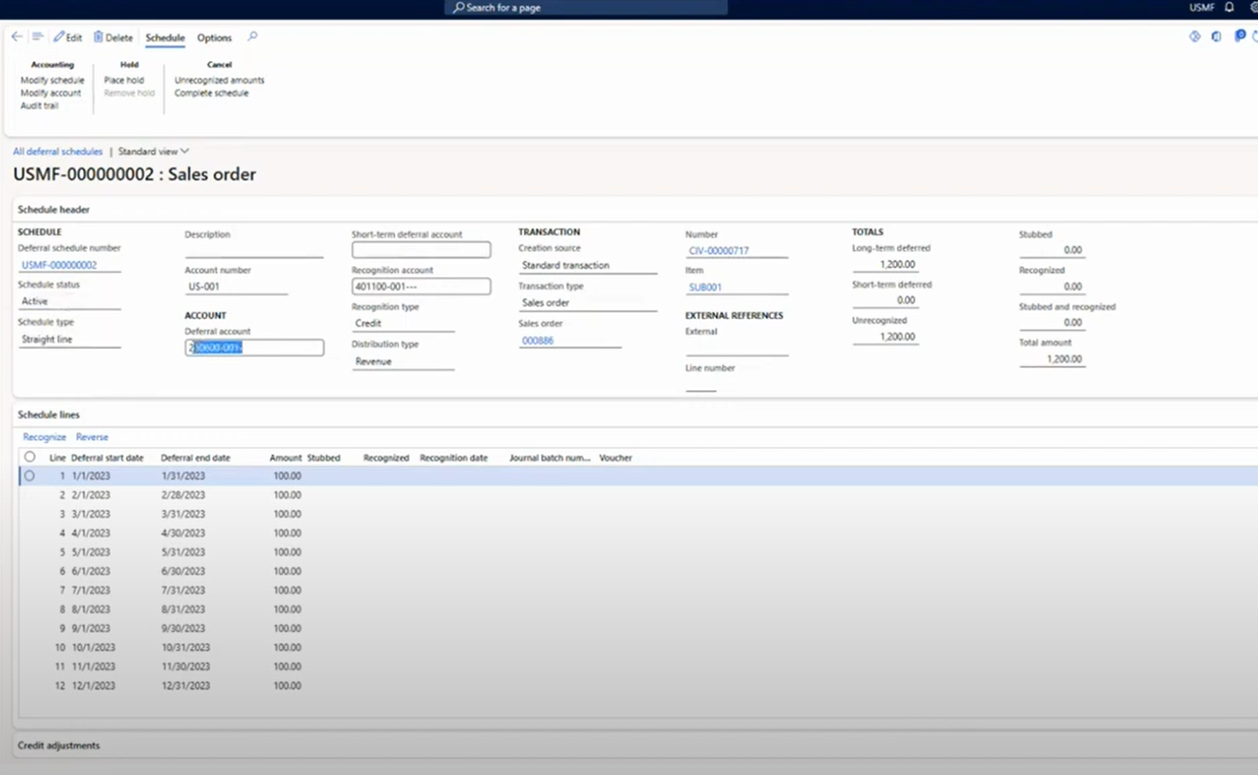

All Deferral schedules-

1. Once the invoice is posted, we can visit all deferral schedules and it will show the sales order invoice created by us.

2. If we want to stop recognising in any month we can put place on Hold option which is available

3. We can either click on each line as recognise and that month revenue will be recognised but since we cannot do it each line wise or each sales order wise, we need to schedule a batch job which will recognise the revenue

4. In periodic tasks we have recognition processing batch job option, select the required details.

MIGRATION PROCESS-

1. Export data from Deferred line (RevRecDeferredLineEntity) using the Data management workspace from Revenue recognition

2. Migrate the data to this particular data entity for subscription billing module (SubBillDeferralScheduleTableEntity)

Below is the field mapping for data entity in data management

Related Articles

Intercompany Direct delivery (Three way)

Business Scenario: Selling company: GT01 Supplying company: AE01 External customer: Any customer (Test1) PO: Purchase order SO: Sales order IC: Intercompany External customer create PO with the selling company (Gt01). The sales order (S0-1) is ...